Vijay Shekhar Sharma is the founder of Paytm and the face of India’s digital revolution. His journey is not just about building a company, but about breaking all limits—of language, money, and fear—to teach India how to pay through mobile.

Early Life and Education

Vijay Shekhar Sharma was born on July 8, 1978, in a small village in Aligarh, Uttar Pradesh. His father was a school teacher and his mother a homemaker. He studied in a Hindi-medium government school, where even understanding English was difficult. But inside him, there was a fire to do something big.

When he joined Delhi College of Engineering (now DTU) for higher studies, English became his biggest challenge. He couldn’t understand lectures or textbooks properly. But instead of giving up, he started learning English by himself—reading newspapers, listening to songs, and practicing every day until he gained confidence.

First Startup and Early Struggles

During college, Vijay fell in love with technology. In 1997, he launched a company called XS Corps that built websites. Along with a few friends, he also created a content management system similar to what WordPress is today.

He didn’t have a laptop or money. He worked from cyber cafes, coding late into the night. There were times when he didn’t even have enough money for food, but he never complained. He had a dream and believed in it with all his heart.

Start of Paytm

In 2000, Vijay started One97 Communications, which later became the parent company of Paytm. It offered value-added mobile services like caller tunes and alerts. But the real revolution came in 2010 when he launched Paytm—short for “Pay Through Mobile.”

At first, Paytm was only for mobile recharges and bill payments. But Vijay had a bigger dream—he wanted people to use mobile for everything, from buying tea to booking flight tickets. So he launched the Paytm Wallet, and soon, shops, autos, and businesses across India started accepting Paytm.

The Rise to Success

Paytm’s biggest growth came in 2016 during demonetization. With cash suddenly out of reach, India turned to digital payments—and Paytm was ready. In that one year, millions of new users joined Paytm and the company’s value grew rapidly.

In 2017, Paytm launched its own bank—Paytm Payments Bank. It then added services like Paytm Mall and Paytm Money. In 2021, the company went public with India’s largest IPO.

Challenges and Criticism

As the company grew, so did the problems. The IPO did not perform well in the stock market, and the company had to face financial losses and declining user trust.

Vijay also faced personal attacks and was even seen crying during a press conference. But he didn’t give up. He revised his strategies, strengthened his team, and worked hard to keep Paytmon top.

Paytm’s Present and Future

Today, Paytm is not just a wallet. It is a full digital ecosystem that offers payments, banking, investment, shopping, and more—all on one app. Vijay’s dream is to make India truly cashless, and Paytm is playing a big part in that journey.

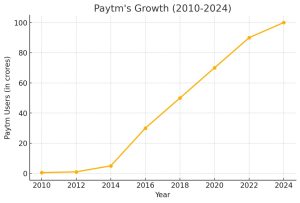

Paytm's Growth (2010–2024)

This graph clearly shows how Paytm's user base grew rapidly between 2010 and 2024. From just 50 lakh users in 2010 to over 10 crore in 2024, the growth is nothing short of incredible. Demonetization acted as a major turning point, pushing the platform into every corner of the country.

Vijay Shekhar Sharma’s story is proof that dreams don’t need perfect English or a rich background—just courage and belief. He broke through language barriers, survived financial struggles, and built one of India’s most trusted tech brands. Today, he represents the face of India’s digital future.

At Bada Business, we believe in such stories of courage and transformation. We proudly support small businesses and new entrepreneurs, because together, we can make the Indian economy stronger.