Angel investors have become a vital part of the startup ecosystem, providing much-needed capital and expertise to early-stage businesses.

In this blog, we'll explore who these investors are, how they operate, and the benefits and risks associated with angel investing. Whether you're an aspiring entrepreneur or someone interested in becoming an investor, this guide will offer valuable insights into the world of angel investing.

Who Are Angel Investors?

Angel investors are typically affluent individuals who provide capital to startups or early-stage businesses in exchange for equity or convertible debt. Unlike venture capitalists, who manage pooled funds from multiple investors, angel investors usually invest their own money. Often, these investors have a keen interest in helping emerging businesses grow and succeed, leveraging their experience, networks, and resources. Many angel investors are former entrepreneurs or professionals who have accumulated significant wealth and now seek to support the next generation of innovators.

What Is Angel Investing?

Angel investing refers to investing in small businesses or startups, often at the very early stages of their development. This type of investment is usually high-risk but can offer high rewards if the startup succeeds. Angel investors typically provide seed capital, which is the initial funding needed to launch the business. In exchange for their investment, they receive equity or convertible debt, which can later be converted into shares if the company grows. Angel investing is crucial for startups that lack access to traditional funding sources like banks or venture capital firms.

How Angel Investing Works?

Angel investing usually starts with a pitch from the startup’s founders. This pitch is a presentation designed to showcase the business idea, market opportunity, financial projections, and team capabilities. If the angel investor is interested, they will conduct due diligence, which involves evaluating the startup’s business plan, market potential, competitive landscape, and team. If everything checks out, the investor negotiates the terms of the investment, including the amount of equity they will receive in exchange for their investment. Once both parties agree, the angel investor provides the capital, and the startup uses it to grow its business.

How Many Types of Angel Investors?

There are several types of angel investors, each with their unique characteristics and motivations:

- Super Angels: These are individuals who invest large amounts of capital and often act like venture capitalists by participating in multiple funding rounds.

- Serial Angels: These investors frequently invest in startups, usually spreading their capital across multiple ventures to diversify risk.

- Corporate Angels: These are professionals who have taken early retirement or left their corporate jobs and are now investing in startups, often in industries they are familiar with.

- Entrepreneurial Angels: These are former entrepreneurs who have successfully built and exited their own companies. They often bring valuable experience and mentorship to the startups they invest in.

- Family and Friends: These are non-professional investors, often close friends or relatives of the entrepreneur, who invest out of personal connection and trust.

How to Become an Angel Investor?

Becoming an angel investor requires a combination of financial readiness, market knowledge, and a strong network. Here are the steps to get started:

- Assess Your Finances: Angel investing is risky, and you should only invest money you can afford to lose. Ensure you have a robust financial base before you begin.

- Educate Yourself: Learn about different industries, market trends, and the startup ecosystem. Attend workshops, read books, and join networks or groups of angel investors.

- Build a Network: Connect with other investors, entrepreneurs, and industry experts. Networking can provide valuable insights and opportunities for co-investing.

- Start Small: Begin with smaller investments to gain experience. This allows you to learn from each venture and refine your strategy.

- Conduct Due Diligence: Always thoroughly research the startups you're considering investing in. Look beyond the business idea and evaluate the team's ability to execute it.

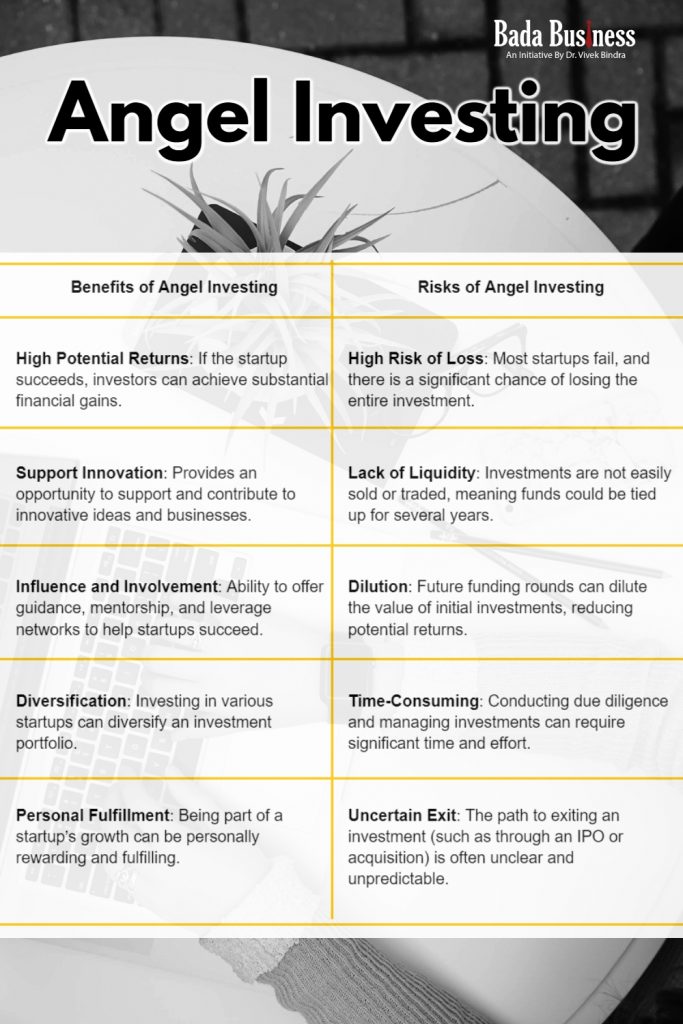

Benefits of Angel Investing:

Angel investing offers several benefits. For starters, it provides the opportunity to support innovative startups and potentially make a substantial return on investment if the company succeeds. Angel investors often have the chance to influence the direction of the business, contributing their expertise and networks. Additionally, investing in startups can be personally rewarding, allowing investors to play a direct role in the growth and success of new businesses.

What Are the Risks of Angel Investing?

Despite its potential rewards, angel investing comes with significant risks. The most obvious risk is the potential loss of capital. Most startups fail, and there's a high probability that the investment may not yield any returns. Liquidity is another concern; angel investments are not easily sold or traded, meaning your money could be tied up for several years. Additionally, there’s the risk of dilution if the startup raises more capital in the future, which can reduce the value of the initial investment.

Conclusion:

Angel investors are essential to the startup ecosystem, providing capital, mentorship, and support to early-stage businesses. While angel investing can offer high rewards, it also comes with substantial risks. For those looking to become angel investors, being financially prepared, educated, and well-connected is crucial. By understanding the dynamics of angel investing and carefully selecting investments, investors can contribute to the growth of innovative companies and potentially reap significant financial rewards.